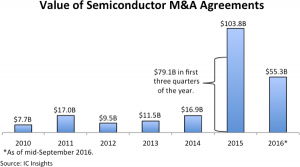

Semiconductor market: another booming year for M&A

After an historic surge in semiconductor merger and acquisition agreements in 2015, the torrid pace of transactions has eased (until recently), but 2016 is already the second-largest year ever for chip industry M&A announcements, thanks to three major deals struck in 3Q16 that have a combined total value of $51.0 billion. As of the middle of September, announced semiconductor acquisition agreements this year have a combined value of $55.3 billion compared to the all-time high of $103.8 billion reached in all of 2015. Through the first three quarters of 2015, semiconductor acquisition pacts had a combined value of about $79.1 billion, which is 43% higher than the total of the purchasing agreements reached in the same period of 2016, based on M&A data compiled by IC Insights.

In many ways, 2016 has become a sequel to the M&A mania that erupted in 2015, when semiconductor acquisitions accelerated because a growing number of suppliers turned to purchase agreements to offset slower growth in major existing end-use equipment applications (such as smartphones, PCs, and tablets) and to broaden their businesses to serve huge new market potentials, including the Internet of Things (IoT), wearable electronics, and strong segments in embedded electronics, like highly-automated automotive systems. China’s goal of boosting its domestic IC industry is also driving M&A. In the first half of 2016, it appeared the enormous wave of semiconductor acquisitions in 2015 had subsided substantially, with the value of transactions announced between January and June being just $4.3 billion compared to $72.6 billion in the same six-month period in 1H15. However, three large acquisition agreements announced in 3Q16, SoftBank’s purchase of ARM, Analog Devices’ purchase of Linear Technology, and Renesas’ acquisition of Intersil have insured that 2016 will be second only to 2015 in terms of the total value of announced semiconductor M&A transactions.

A major difference between the huge wave of semiconductor acquisitions in 2015 and the nearly 20 deals being struck in 2016 is that a significant number of transactions this year are for parts of businesses, divisions, product lines, technologies, or certain assets of companies. This year has seen a surge in the agreements in which semiconductor companies are divesting or filling out product lines and technologies for newly honed strategies in the second half of this decade.

FF

Contenuti correlati

-

Socionext announces collaboration with Arm and TSMC

Socionext announced a collaboration with Arm and TSMC for the development of an innovative power-optimized 32-core CPU chiplet in TSMCʼs 2nm silicon technology, delivering scalable performance for hyperscale data center server, 5/6G infrastructure, DPU and edge-of-network markets....

-

Intel Foundry and Arm announce multigeneration collaboration

Intel Foundry Services (IFS) and Arm announced a multigeneration agreement to enable chip designers to build low-power compute system-on-chips (SoCs) on the Intel 18A process. The collaboration will focus on mobile SoC designs first, but allow for...

-

Mentor partners with Arm to help the functional verification of next-generation ICs

Mentor, a Siemens business, announced a partnership with Arm to help integrated circuit (IC) designers optimize and streamline the functional verification of their Arm-based designs. With this collaboration, the Arm Design Reviews program now offers the expertise...

-

NVIDIA to Acquire Arm

NVIDIA and SoftBank Group Corp. (SBG) announced a definitive agreement under which NVIDIA will acquire Arm Limited from SBG and the SoftBank Vision Fund in a transaction valued at $40 billion. The combination brings together NVIDIA’s leading...

-

Silicon Labs’ new Low-Power MCU

Silicon Labs has expanded its EFM32 Gecko portfolio with new industrial-strength microcontrollers. The EFM32GG11 Giant Gecko MCU family is suitable for smart metering, asset tracking, industrial/building automation, wearables and personal medical applications. The Giant Gecko family is...

-

Fenway Embedded Systems: Atollic TrueSTUDIO is available for use on Linux workstations

Atollic AB, distributed in Italy by Fenway Embedded Systems, has announced that the Atollic TrueSTUDIO development tool suite has been released for use on Linux workstations. The version 8.0 of Atollic TrueSTUDIO IDE is now available for...

-

ARM buys Apical

ARM has acquired embedded vision specialist Apical for $350 million in cash. The acquisition supports ARM’s long term growth strategy by enabling new imaging products for next generation vehicles, security systems, robotics, mobile and any consumer, smart...

-

Intel Xeon D Doubles Core Count

Intel recently released six new Xeon D server and embedded processors with 12-16 cores. These new models target 45-65W TDPs and run at base frequencies, between 1.3GHz and 1.8GHz. The company unveiled the first Xeon D in...

-

Amazon, a new entry in the chip market

Annapurna Labs Inc, a subsidiary of Amazon.com, has announced the availability of its Alpine range of ARM-based chips and subsystems aimed at home use Wi-Fi routers NAS (Network-Attached Storage) devices. Annapurna was founded in 2011 and was...